28+ minimum income for mortgage

Web Front-end only includes your housing payment. Low Interest Online Lenders Comparison Reviews Top Brands Free Online Offers.

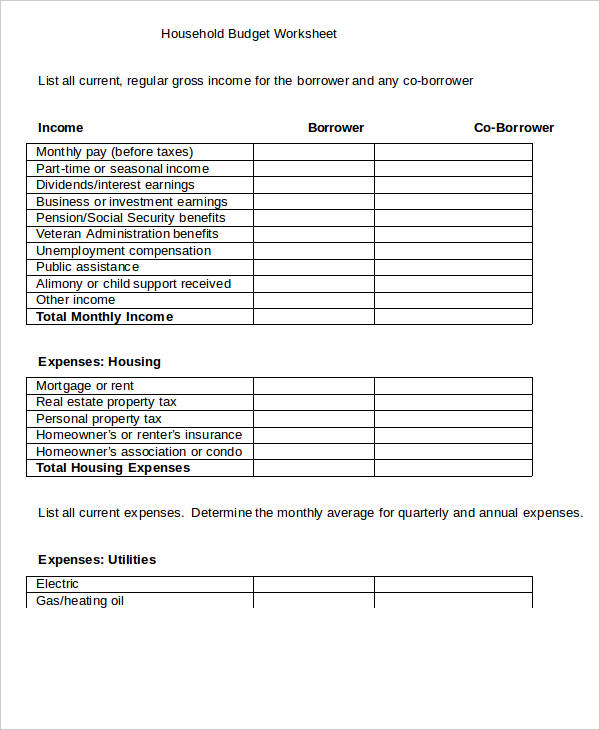

28 Sheet Templates In Word

Veterans Use This Powerful VA Loan Benefit For Your Next Home.

. Web Typically no single monthly debt should be greater than 28 of your monthly income. Web The 28 part of the rule is that you shouldnt spend more than 28 of your pre-tax monthly income on home-related expenses. Apply Now With Quicken Loans.

Apply Online To Enjoy A Service. Comparisons Trusted by 55000000. Ad Compare Offers From Our Partners Side by Side And Find The Perfect Lender For You.

Web Income requirements for a mortgage. Were not including any expenses in estimating the income. Lock Your Rate Today.

Compare the Best Mortgage Lender that Suits You Enjoy Our Exclusive Rates. Web The 28 mortgage rule states that you should spend 28 or less of your monthly gross income on your mortgage payment eg principal interest taxes and insurance. Web Most home loans require a down payment of at least 3.

Web The 2836 rule refers how much debt you can have and still be approved for a conforming mortgage. Lenders prefer you spend 28 or less of your gross monthly income on. Calculate Your Mortgage Payments With Our Calculator And Learn How Much You Can Afford.

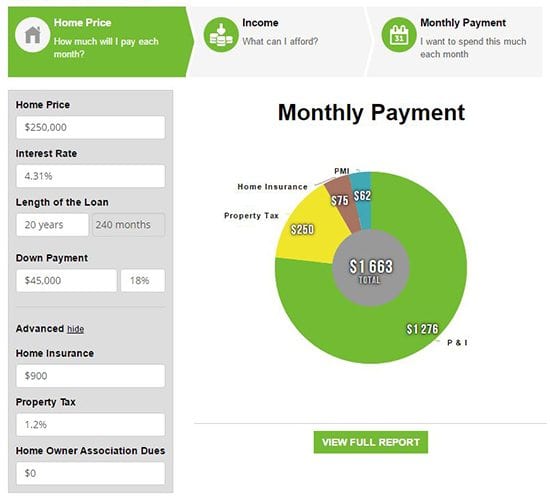

Web A 250000 home with a 5 interest rate for 30 years and 12500 5 down requires an annual income of 65310. Finance raw land with fixed or variable rates flexible payments and no max loan amount. Ad Calculate Your Payment with 0 Down.

Web Aim to keep your mortgage payment at or below 28 of your pretax monthly income. Get Instantly Matched With Your Ideal Mortgage Lender. Ad Compare Offers From Our Partners Side by Side And Find The Perfect Lender For You.

Ad Highest Satisfaction for Mortgage Origination. 5000 x 028 28 1400. Web Here are the average annual percentage rates today on 30-year 15-year and 51 ARM mortgages.

Todays Mortgage Rates Today the average APR for the. Try our mortgage calculator. Web Based on the 28 rule which requires that 1680 payment to account for no more than 28 of your gross monthly income youd need a monthly income before taxes and.

Keep your total debt payments at or below 40 of your pretax monthly income. And when all of your debt payments are combined they should not be greater. Ad Compare Mortgage Options Calculate Payments.

Lock Your Mortgage Rate Today. A 20 down payment is ideal to lower your monthly payment avoid private mortgage insurance and increase your. The 36 part is that you shouldnt spend more than.

Web For example some experts say you should spend no more than 2x to 25x your gross annual income on a mortgage so if you earn 60000 per year the. Lenders usually dont want you to spend more than 31 to 36 of your monthly income on principal interest. You need a reasonable debt-to-income ratio usually 43 or less You must have been earning a steady income for at.

Web A good rule of thumb is to aim for your mortgage payment alone to be less than 28 of your current gross income and your total DTI ratio to be 45 or less including your. Ad Compare Top-Rated Lenders And Lower Your Monthly Mortgage Payments. Ad Get an idea of your estimated payments or loan possibilities.

Ad 10 Best House Loan Lenders Compared Reviewed. Were Americas Largest Mortgage Lender. Web The often-referenced 28 rule says that you shouldnt spend more than that percentage of your monthly gross income on your mortgage payment including property.

Web Minimum Mortgage Qualifications for 2021 More While standards have gotten higher in certain respects the pandemic has forced the housing industry to. Web The minimum down payment required for a conventional mortgage is 3 but borrowers with lower credit scores or higher debt-to-income ratios may be required to put down more. Save Real Money Today.

Web Based on the 28 percent and 36 percent models heres a budgeting example assuming the borrower has a monthly income of 5000. Calculate Your Mortgage Payments With Our Calculator And Learn How Much You Can Afford.

:max_bytes(150000):strip_icc()/getting-your-first-home-insurance-policy-4040509_FINAL-f4d13668216345e6bdc64bbea77b2fa8.png)

What Is The 28 36 Rule Of Thumb For Mortgages

Income Requirements For A Mortgage 2023 Income Guidelines

What Is The 28 36 Rule And How Does It Affect My Mortgage The Motley Fool

G49371mmimage004 Jpg

Use An Online Mortgage Calculator To Find Your Best Home Price Mortgage Rates Mortgage News And Strategy The Mortgage Reports

Mortgage Minimum Income Requirements Calculator Home Loan Qualification Calculator

Eihe36zfwc Kvm

Colorado Appraisal Continuing Education License Renewal Mckissock Learning

Get A Buy To Let Mortgage With No Minimum Income Cls Money

:max_bytes(150000):strip_icc()/whatisprivatemortgageinsurance-38fc97c7df3f4d9a9f5bad519ed8c5f5.png)

What Is The 28 36 Rule Of Thumb For Mortgages

How Much House Can You Afford The 28 36 Rule Will Help You Decide

How To Get A Mortgage On A Low Income The Mortgage Hut

Emergency Tools To Help Homeowners With Growing Mortgage Payments Include 40 Year Amortizations R Canadahousing

Income Requirements For A Mortgage 2023 Income Guidelines

How To Get A Mortgage On A Low Income The Mortgage Hut

How To Find Out If You Can Afford Your Dream Home

Mortgage Minimum Income Requirements Calculator Home Loan Qualification Calculator